Over 16,539,708 people are on fubar.

What are you waiting for?

Kurt Nimmo

Infowars.com

November 19, 2012

Congress is currently in discussions with the Obama administration about enacting a new round of taxes to pay for profligate government spending. The increase will fall on the “rich,” defined by the government as anybody who earns more than $250,000 a year.

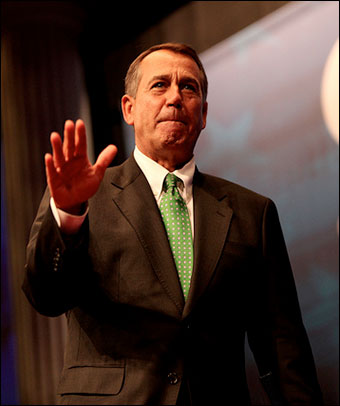

House Speaker John Boehner’s “top earners” category does not include the financial elite. Photo: Gage Skidmore.

House Speaker John Boehner’s “top earners” category does not include the financial elite. Photo: Gage Skidmore.Democrats are all for taxing the so-called rich, while Republicans favor going after entitlements in order to confront the so-called “fiscal cliff.” Republicans, however, have agreed to not “explicitly reject the suggestion they accept a Senate-passed bill that would allow tax rates to rise on top earners,” in other words the last remaining producers of wealth in the United States.

An aide to House Speaker John Boehner said in December GOP bosses will accept an increase in taxes on “top earners” in exchange for agreement on binding tax and entitlement reform mechanisms next year, the National Post reports.

Boehner’s “top earners” category does not include the financial elite. Prior to the imposition of federal income taxes early in the last century, the elite had established tax avoidance foundations under the cover of humanitarianism.

“By the time the income tax became law in 1913, the Rockefeller and Carnegie foundations were already operating. Income tax didn’t soak the rich, it soaked the middle class,” write James Perloff. “Because it was a graduated tax, it tended to prevent anyone from rising into affluence. Thus it acted to consolidate the wealth of the entrenched interests, and protect them from new competition.”

The Dodd report to the Reece Committee on Foundations concluded that the financial elite had established their foundations to enable oligarchical collectivism, or corporatism (otherwise known as fascism, as Mussolini described it), in addition to tax avoidance.

“The president’s definition of ‘rich’ would… include some 750,000 independent and small businesses that do not pay income taxes as businesses; instead, their taxes are paid through the owners’ individual tax returns. We are not exactly talking Warren Buffett here,” Michael D. Tannerwrote for the Cato Institute in July.

According to the U.S. Small Business Administration, small business represents 99.7 percent of all employer firms, employ half of all private sector employees, create more than half of the non-farm private GDP, pay 44 percent of total U.S. private payroll, and have generated 65 percent of net new jobs over the past 17 years.

“Moreover, many Americans earning less than $200,000 are likely to suffer collateral damage from this tax increase,” Cato continues. “For example, the president’s proposed tax hike on capital gains is likely to reduce the value of 401(k) funds that millions of middle-income Americans rely on for retirement. And the business taxes will drive up the prices of goods and services, not to mention costing jobs. Given current unemployment rates, it seems especially hard to think of any reason why raising taxes on small businesses would be a good policy.”

In response to the Democrat plan to bankrupt America and send producers fleeing, “GOP leaders said that their staffs would work in the coming week on binding proposals to reform the tax code and get savings from entitlement programs.”

The government is addicted to debt and they expect the politically disenfranchised – everybody except the financial elite – to pay for it.

As Andrew P. Napolitano notes, “both political parties have chosen to spend today and put the burden of paying for the spending onto future generations. The debt keeps increasing, and the feds have no intention of paying it off. Every time the government has wanted to increase its lawful power to borrow since World War II, members of Congress and presidents from both parties have permitted it to do so.”